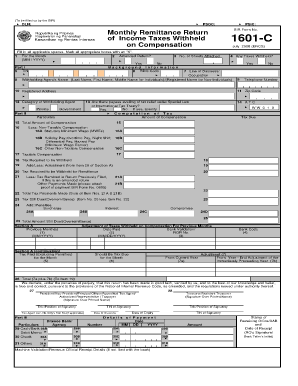

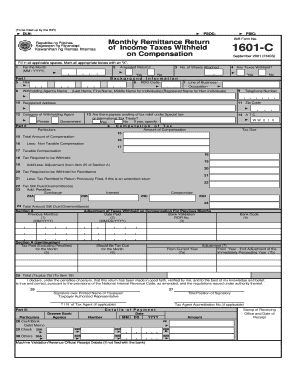

Who must File BIR Form 1601?

BIR Form 1601 is known as the Monthly Remittance Return of Income Taxes Withheld on Compensation. Every withholding agent must complete and submit this form in triplicate. An applicant may be an individual or non-individual who must deduct and withhold taxes on compensation that is paid to their employees.

What is BIR Form 1601 for?

This form’s main purpose is to report the monthly income tax return on the employees’ compensation.

When is BIR Form 1601 Due?

There is a special due date for this form. An applicant must submit this document by the tenth day of the month that follows the month when the withholding of the taxes has been made (except for December). If you fail following this due date, you may face certain penalties.

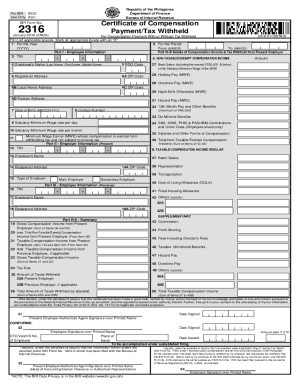

Is BIR Form 1601 Accompanied by Other Forms?

There are no specific documents that must be attached to the Monthly Remittance Return of Income Taxes Withheld on Compensation. However, if you attach some documents, you must indicate the number of sheets you attach in the form.

What Information do I Include in BIR Form 1601?

The following information must be indicated in BIR Form 1601:

-

Month and year;

-

Number of sheets attached;

-

If the return is amended or not;

-

Background information: TIN, DO code, occupation/type of business, name of the withholding agent, registered address, telephone number, category of withholding agent;

-

Computation of the tax;

-

Details of payments.

Pay attention to the part of the form devoted to the computation of the tax. A single mistake in calculations may lead to negative consequences.

Where do I Send BIR Form 1601?

The Authorized Agent Bank is the institution that will process your filed form.